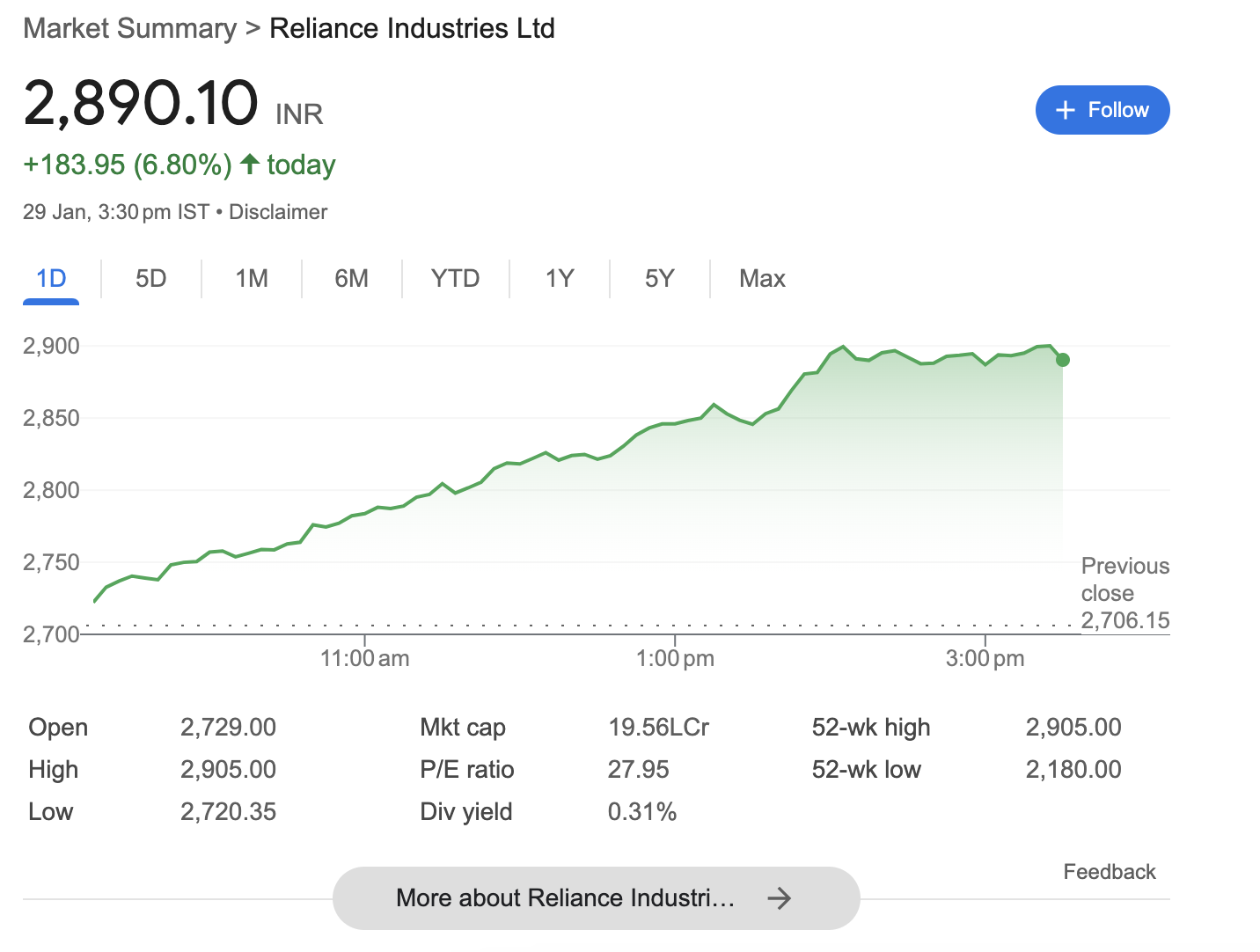

Reliance percentage rate The Reliance percentage fee has been displaying steady growth during the last few months. With their current ventures into numerous sectors and strong financial overall performance, traders have shown an extraordinary deal of self-assurance in the organization. As of nowadays, the percentage charge stands at ₹2,000, making it an attractive option for those seeking to put money into a reliable and promising organization. However, please note that stock prices are difficult to marketplace fluctuations and it is usually really useful to do thorough studies before making any investment selections. Indeed, the Reliance percentage fee has been on a regular upward trajectory in current months. The employer’s strategic expansion into special sectors and their sturdy monetary overall performance have instilled a feeling of self-assurance among investors. Currently, the proportion rate stands at ₹2,000, making Reliance an attractive preference for ability traders looking for reliability and promising returns.

Moreover, Reliance Industries has continually delivered strong financial performance, bolstering investor confidence. Its robust income increase and green capital allocation have attracted domestic and global investors to the organization.

As a result of those fine traits, the Reliance share price has skilled a regular upward trajectory in current months. Currently status at ₹2,000, the percentage rate reflects the market’s confidence in Reliance as an investment preference.

However, it’s far crucial for capability investors to exercise warning and conduct thorough research earlier than making any funding decisions. Stock expenses are problem to marketplace fluctuations, and it’s far essential to apprehend the underlying elements that might affect the organization’s performance.

Reliance Industries’ strategic expansion into exclusive sectors has been instrumental in its success. Under the management of Mukesh Ambani, the organization has made good-sized strides in telecommunications, electricity, retail, and digital services. This diversification has no longer only created new avenues for revenue but additionally located Reliance as a prominent player in India’s dynamic commercial enterprise landscape.

The corporation’s telecommunications assignment, Jio, has disrupted the enterprise with less costly records plans and significant community insurance. With hundreds of thousands of subscribers, Jio has emerged as an impressive competitor, with difficult established players and shooting a massive marketplace share.

In the power area, Reliance Industries has made great investments in refining and petrochemicals, solidifying its function as one of the largest strength corporations in the world. The corporation’s latest facilities and superior era have enabled it to optimize its operations and deliver terrific products to a global market.

In the retail zone, Reliance has revolutionized the way Indians keep with its chain of shops under the brand called Reliance Retail. With a wide variety of products and services, Reliance Retail has efficaciously catered to the various needs of purchasers throughout the u . S . A .. The organization’s modern method and client-centric recognition have contributed to its fast boom in this quite competitive zone.